Maximum Property Tax Deduction 2024

Maximum Property Tax Deduction 2024. If total net assessed value rises by 6 percent, and the levy rises by 4.5 percent, the average tax rate should fall about 1.5 percent. Tax bills on higher valued homes will increase more.

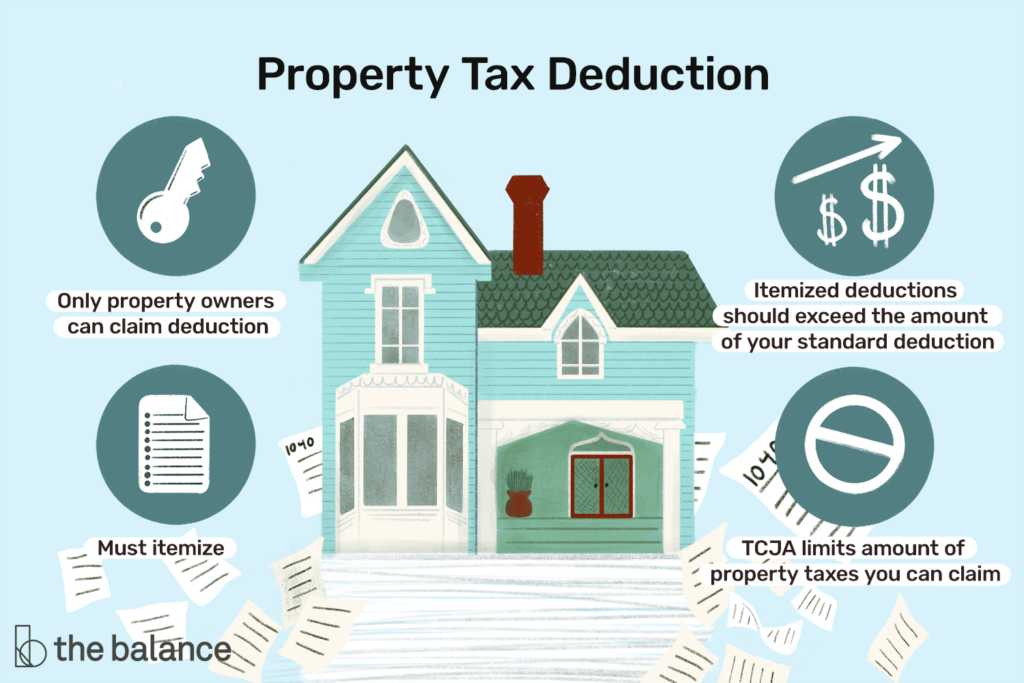

The property tax deduction allows you as a homeowner to write off state and local taxes you paid on your property from your federal income taxes. Homeowners can deduct interest on up to $750,000 of mortgage debt ($375,000 if married filing separately) on a primary or secondary home.

The Property Tax Deduction Is Great For Homeowners.

How tax deductions and tax credits work, plus 22 tax breaks that might come in handy for the 2024 filing season.

You Can Claim A Deduction For Real Property Taxes If The Tax Is Uniform—The Same Rate Is Applied To All Real Property In The Tax Jurisdiction.

The procedure to calculate the maximum real property tax deduction for 2024 involves a series of steps that are designed to ensure accuracy and compliance with the relevant tax.

To Maximize Your Mortgage Interest Tax Deduction, Utilize All Your Itemized Deductions So They Exceed The Standard Income Tax Deduction Allowed By The Internal.

Images References :

Source: www.pinterest.com

Source: www.pinterest.com

How to Deduct Property Taxes On IRS Tax Forms Irs tax forms, Mortgage, Owning a rental property can generate income and some great tax deductions. Rules for the property tax deduction.

Source: www.pinterest.ph

Source: www.pinterest.ph

Rental Property Tax Deductions A Comprehensive Guide Credible Cash, How tax deductions and tax credits work, plus 22 tax breaks that might come in handy for the 2024 filing season. You owned the home in 2023 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2024 return of $946 [(243 ÷ 365) × $1,425] paid in 2024 for 2023.

Source: pix4free.org

Source: pix4free.org

Free of Charge Creative Commons property tax deduction Image Real, You owned the home in 2023 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2024 return of $946 [(243 ÷ 365) × $1,425] paid in 2024 for 2023. If you pay taxes on your personal property and real estate that you own, you payments may be deductible from your federal income tax bill.

Source: www.joust.com.au

Source: www.joust.com.au

Tax Deductions for Investment Property What to Claim? Joust, If you pay taxes on your personal property and real estate that you own, you payments may be deductible from your federal income tax bill. You owned the home in 2023 for 243 days (may 3 to december 31), so you can take a tax deduction on your 2024 return of $946 [(243 ÷ 365) × $1,425] paid in 2024 for 2023.

Source: www.taxhelpdesk.in

Source: www.taxhelpdesk.in

Changes In New Tax Regime All You Need To Know, Here are five rental property tax deductions that should be on your radar. How tax deductions and tax credits work, plus 22 tax breaks that might come in handy for the 2024 filing season.

Source: whiteluxuryhomes.com

Source: whiteluxuryhomes.com

Property Tax Deductions What You Need to Know! White Luxury Homes, Here are some tips to help you get the most out of your property tax deduction: Learn about the deductibility of real estate taxes on your federal income tax returns, including the conditions and limitations.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, How tax deductions and tax credits work, plus 22 tax breaks that might come in handy for the 2024 filing season. A tax credit would lower the amount.

Source: www.forbes.com

Source: www.forbes.com

Standard Deductions for 20232024 Taxes Single, Married, Over 65, Learn about the deductibility of real estate taxes on your federal income tax returns, including the conditions and limitations. For 2024, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying children—it.

Source: www.researchgate.net

Source: www.researchgate.net

Example tax deduction system for a single glutenfree (GF) item and, How tax deductions and tax credits work, plus 22 tax breaks that might come in handy for the 2024 filing season. Learn about the deductibility of real estate taxes on your federal income tax returns, including the conditions and limitations.

Source: www.surex.com

Source: www.surex.com

Guide to Rental Property Tax Deductions in Canada Surex, Owning a rental property can generate income and some great tax deductions. Find out how to claim real estate tax.

A Homestead’s 4 Percent Rise.

To maximize your mortgage interest tax deduction, utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the internal.

Homeowners Can Deduct Interest On Up To $750,000 Of Mortgage Debt ($375,000 If Married Filing Separately) On A Primary Or Secondary Home.

Rules for the property tax deduction.